Part 1: The market of the CRM study

In a CRM study, the Muuuh Group recorded the current status of CRM activities in Germany. We reported. We will examine the results of the study in several articles. The main topics are the market, the goals, the selection, the use and the customer experience touchpoints.

First of all: Who was interviewed?

A total of more than 830 participants were surveyed, 19% were top decision makers, 55% CRM users (employees) and 26% CRM project managers.

18% of the respondents were from large companies. The respondents of the study had their industry focus in industry, construction and services.

1. CRM Study – the market

The first part deals with the CRM market:

The first chart is about the market shares of CRM systems. SAP is the leading system provider among the study participants. This is plausible, since the respondents come from medium-sized and large companies where SAP is often used as ERP and therefore SAP as CRM. Oracle is still relatively far ahead with Siebel. This is quite surprising, because in Germany Oracle with its CRM has not been so strongly perceived lately.

Chart number 2 deals with market shares by company size. Microsoft Dynamics has a strong dominance in the size range of 51-500 employees. Companies decide to introduce Microsoft as a CRM system because the Office package is common in most companies. The 45% for SAP in very large companies is logical, since large companies often use SAP.

The third chart shows the market shares by business sector. It is interesting to note here that the in-house development of a CRM system is very pronounced in the public sector/education/health and in the finance/insurance sector.

In terms of the entire world market (see our article on this topic), the opposite is the case: In first place – by a wide margin – is Salesforce. Then comes Microsoft and SAP in third place.

2. the objectives of the CRM study at a glance

Chart 1 shows the answers to the question “What is important for the success of a company”. 79% of those surveyed believe that the systematic management of customers is extremely important.

Still silos “in your head”?

Unfortunately, we recognize from the further answer option “Customer information is ideally exchanged between all important departments (sales, marketing and customer service) in our company for the purpose of providing the best possible customer service” that an extreme silo thinking still prevails in 56 % of the respondents. This shows that, unfortunately, blinkers are still present in companies.

51 % of those surveyed have given the answer “Your customer data is always up-to-date”. Unfortunately, this also shows that every second person knows that “his” customer data is not up to date or is not in a satisfactory condition. This is remarkable because at the moment everyone is talking about artificial intelligence (AI) or personalization and individualization. For the last two topics alone, complete and properly maintained information is particularly important. But let’s read on to the question about the goals of customer management CRM marketing sales

Already at this early point we want to ask the question: Do the results rather reflect what the managing directors or the employees say?

The chart “What do you associate with the term CRM?” also contains exciting results.

Surprisingly, 19% of those surveyed associate “non-technological aspects” with the abbreviation CRM. This means that they view CRM only from a strategic and communicative perspective. Not surprisingly, the approx. 80 % who say that for them CRM is both technological and non-technological.

The next question asked was what the respondent understood by CRM.

With these results, too, we want to remind you who was interviewed (see part 1 of our analysis). Are the answers influenced by the managers or the employees?

Because the percentage values for learning process (25 %), company philosophy (19 %), marketing ( 33 %) and sales ( 31 %) are very low. And this despite the fact that the answer option customer management ( 58 %) comes first.

The subject of customer data

In the chart “Main objectives of systematic management of customer data” we see some wasted potential. The most important one is “Targeted marketing” (70 %). What astonishes us is that customer data is hardly ever used for the topics “saving costs”, “increasing productivity” and “developing new products and services”. But exactly these points are the big levers! Currently, in the Corona crisis, data can be used super fast for exactly this purpose, in order to save costs and develop ideas for new products.

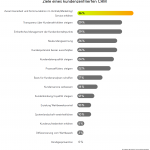

At the end of the charts analysed, the focus is on the goals of a customer-centric CRM system and what the participants associate with it. Basically, we are amazed that the highest percentage of 36% is on the topic of “collaboration in marketing and sales”. Shouldn’t this be given much more weight?

All other topics available for selection are rated even less highly. Very important topics such as “increasing loyalty”, “differentiation from the competition” and the “strategic milestones” can be found at the very bottom of this chart. Even two (“prevention of cancellations” and “recovery of cancellations”) did not receive a 0 % approval rating. Unfortunately, this does not paint a good picture of the current CRM in the companies surveyed.

In the next part we will talk about the selection.

3. the selection of the CRM study at a glance

Let’s go back from chart to chart:

Chart 1 deals with the question of which companies have planned a CRM introduction or replacement. 60 % of those surveyed have a CRM system and do not want to introduce a new one. 30 % still want to introduce a CRM system. Furthermore, 9% say that they want to introduce CRM software.

Whereas 2% do not have CRM software and have no plans to introduce it. The percentage (11%) of companies that do not have a customer relationship management system is surprisingly low. However, it should also be noted that this is not a representative study for German companies.

The results show that 29% of those surveyed are dissatisfied with the current system.

Let’s take a look at the four bubbles on the right. Here you can see that about 60% of the respondents will introduce software in the next 12 months (29%) or are already in the process of doing so (31%). 20 % will introduce software within the next 24 months. Another 20 % plan to introduce software even later.

In the chart “Trigger for the introduction/replacement of the CRM system?” we can see who is behind the decision.

It is interesting to note that 53% of those questioned elected the managing director or the board of directors, which means that the managing directors basically initiated the topic. The first three opinions are 82 % from the management level and 18 % are not from the executive level. Unfortunately, the published results do not indicate what is meant by “others”.

The next question asked was how long the decision phase would take.

With up to one month at 8%, either the pressure was very high or a known tool was simply chosen. Usually a decision phase lasts between 1-6 months, which is reflected in the 69 % as a majority. With the last two times (23%) the task was not prioritized or there were simply too many projects in the making.

Basis for this chart are not all respondents, but only n=169.

Support during the introduction

Points 3 and 4 give 29 %.

Often the software producer tries to be present at the introduction of his product.

With the (10 %) to point 5, it is unfortunately not clear who is meant by this.

Next: the use.

4. an overview of the use of the CRM study

Step by step from chart to chart:

Chart 1 with the headline: “CRM system presence and use”. Here 832 people were interviewed. The result shows that 83 % use the CRM system and on average 13 % have a CRM system but do not use it.

In large companies (lower part) it is almost 20 % who do not use their existing CRM system.

The number of unreported cases is probably significantly higher.

Next chart: “NPS of the CRM system in use”

The NPS (Net Promoter Score) in this chart is -12%, which means that there are more critics in the evaluation of the system used.

The 48 % are exciting, because here it becomes apparent that the majority of the respondents are dissatisfied.

Here, too, a high base was set with 832 respondents, which allows us to make a safe statement.

NPS evaluation of the CRM system providers

The users are satisfied with Mircosoft (+12 %), as well as with CAS (+7 %) and SAP (+3 %). The surveyed users are only partially satisfied with Salesforce (+1%).

Other providers (29 %) and in-house developments (14 %) have a very poor rating in these statistics. Oracle is also rather poor in the evaluation (24 %).

NPS for CRM system after triggering the CRM implementation

Only top decision-makers and project managers were interviewed here.

The board is satisfied, if it should be, because the board decides whether the system is introduced. Whereby one has to ask oneself here whether the board of directors uses the CRM system at all. With the managing directors, one does not know whether they are aware of the problems with the CRM systems. Sales and marketing managers are dissatisfied. Others are unfortunately not properly defined.

Unfortunately a lot of money has been spent here without any visible benefit. At this point one should adjust the CRM system or audit the existing software. In addition, one should train the employees on the system.

In the “NPS by user groups” chart

decision makers have again given good ratings (43% – promoters) and users are dissatisfied (42% – critics). The project managers with 36 % – critics and 30 % promoters are in the middle field here. From this it can also be concluded that the software has either not been adjusted or that the employees have not been trained properly on the CRM system.

Intensity of use of the CRM system in the various divisions

The main users are the employees from the sales department. The highest benefit in sales is 76 %. This percentage refers to the benefit of sales employees, 70% is for sales managers. Customer service and marketing have reached the same percentage of 54%. The benefit in administration is 25% and in public relations 22%. Production (11 %) uses almost no CRM. Here in the overview the technical service is still missing. Conclusion: Missing integration in the rest.

Now to the next chart

“Top 5 reasons to replace a CRM system”

Here, 58% admit to having made a bad purchase because the answer is: limited, missing functionality.

This is where the question must be asked: Will the problems be solved by a replacement?

It is better to tackle the problems and solve them and to adjust and adapt the existing software.

For the 27% (no mobile use possible) the system is probably an old one, as mobile use is most likely included in the new systems. Here, unfortunately, no added value was drawn from the CRM systems.

As the different questions and charts indicate different numbers of respondents, it is difficult to compare them with each other.

“Customer Journey Exists/ Mapped in CRM System”

What about the Customer Journey? At this point it should be noted that only project managers (n=98) were interviewed.

If we add the answer options 1 and 2 together, we arrive at 39%. This means just under 40 % who are more or less dedicated to the topic.

Conversely, this means that about 60 % have not mapped their customer journey or have not defined or documented one at all.

CRM Study on User or Customer Experience and Customer Touchpoints

Next chart: “Availability versus importance of customer data

This chart deals with the importance and availability of customer data and information in the company. Top decision makers and CRM project managers were interviewed (n=169).

The pink/orange bars show the completeness and the grey fields the importance.

The completeness of the contact data in the first chart shows a delta of 24 % points. Nowadays, with regard to personalisation and individualisation, the fill level should be over 90%. Also in the next two answers, many companies lack information regarding customer satisfaction and no customer needs.

If we look at the mentions at the bottom of the chart, we see Only 39% consider the determination of customer acquisition costs to be important. Unfortunately, this is very dramatic and points to a blind flight in control.

It is worth taking a closer look at the results of this chart. Ask yourself how things look in your own company.

“Availability of customer data/information in the company”

Here you can see that about one third has neither complete customer data nor a history of services and products. All other characteristics show that less than half have complete data for customer communication.

This chart should be viewed with reference to chart 2.

Conclusion: The availability of customer data is rather insufficient or even poor at the companies surveyed.

“satisfaction and importance of individual aspects of CRM systems”

This chart reflects the NPS results already listed above.

If we take a closer look at the deltas between importance and satisfaction, “ease of use” is very important (81%), but only 47% are actually satisfied with the usage. This is a very large delta!

On the whole, one can see very well here that many aspects are considered important, but unfortunately do not work properly in practice.

What can be the reason for this? For one thing, it is because the introduction has not been carried out properly. A second reason could be a lack of education and training. And a third reason could be a lack of incentives to collect and maintain data and to enter it into the system.

CRM study on user or customer experience and customer touchpoints

Satisfaction with the CRM system components

The first three answers show that more than half are satisfied. This concerns the aspects “address and contact management”, “appointment and task management” and “internal company communication flow”.

But…

in the remaining 9 of the 12 possible answers, less than 50% are satisfied. This cannot be good. Why? Because the first two functions mentioned are standards, but the rest should be about ease of use and performance. That is a great pity.

“CRM access via mobile devices”

Many laptops are in use, with smartphones in second place and tablets in last place, say the respondents.

There is still a lot of catching up to do in the mobile area, because either people are not willing to invest or there are functions that still do not work on the mobile phone or tablet.

5. let’s now turn to the topic of customer touchpoints

Customer experience in the company

The goal, when we look at these answers, is “to know each customer personally”. Only 43 % as the highest value is, to put it harshly, “an indictment”.

The aspect “company-wide customer orientation and a customer-centred way of thinking” (mentioned by 36 %) shows that 2/3 do not seem to do this.

On the aspect of “Exceptional customer experiences” (32 %), one third think that they offer them. But how does the customer think? Does he see it the same way? Let’s hope so.

In the least mentioned response options, one can see that the aspects “innovation in interaction” (12%) and “uniform platform for presenting all channels” (Customer Data Platform) play only a very weak role. Many people talk about the 360-degree view of a customer, using the information as comprehensively as possible in dialogue with the (potential) customer, but if companies do not do this homework, customer satisfaction will remain at a low level. On the other hand, this is an opportunity for those companies that gain an edge here. So those who do their homework quickly become the customers’ darlings. The envy of the competition is sure to be theirs.

Touchpoints at the customer interface

96 % use e-mail. 88 % store e-mail communication in their CRM system and 8 % leave it in Outlook or similar systems.

Also the activities of the channels “telephone” and “field service” are only 2/3 in the CRM system. A quite high rate of communication has no place in the history and therefore cannot be used for analysis or marketing automation. Forgive opportunity.

All relative “new communication channels” such as SMS, chat, messenger are hardly used by the respondents and are virtually never or only rarely mapped in the CRM software.

Overall conclusion of the CRM study on user or customer experience and customer touchpoints:

Unfortunately, many opportunities remain unused! In the end, it is up to the goals and the leadership to achieve them. Anyone who takes CRM seriously should take these open points seriously. Define goals for teams and areas so that a) the data ends up in the system and b) this data is then also used. This is one of the most important homework for the management and second management level.

If you want to have the whole study, you can “pick it up” directly on the Muuuh-Group website.

Picture source: Cover picture of the Muuuh-Group study

Note: This is a machine translation. It is neither 100% complete nor 100% correct. We can therefore not guarantee the result.